Skip to main content

Services

Resources

Insights

Insights

IntraFi Insights

October 3, 2025

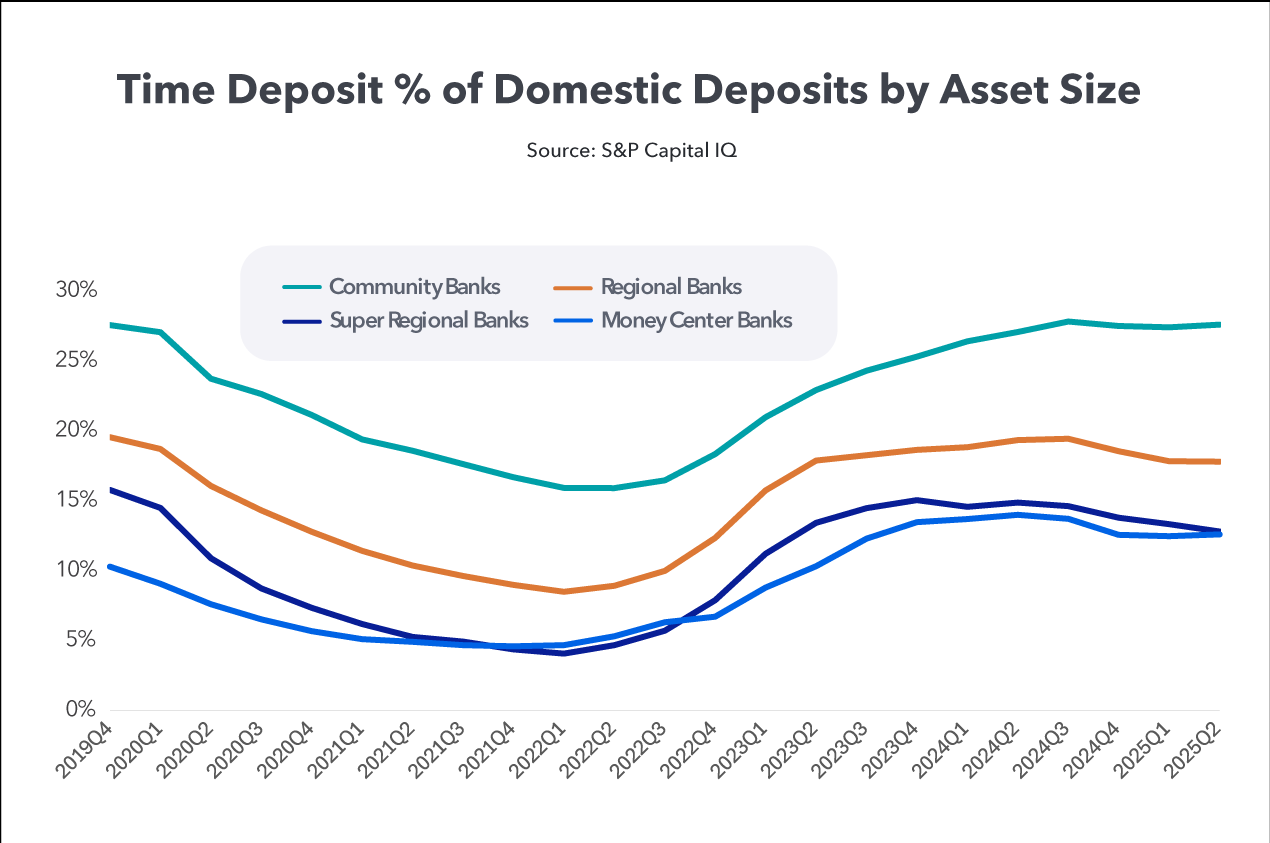

In recent years, community banks have relied on time deposit funding substantially more than their larger bank counterparts. Given that time deposit demand and interest rates historically have risen and fallen together, how has your bank adjusted its funding and/or lending strategies to drive growth in a falling-rate environment?

September 26, 2025

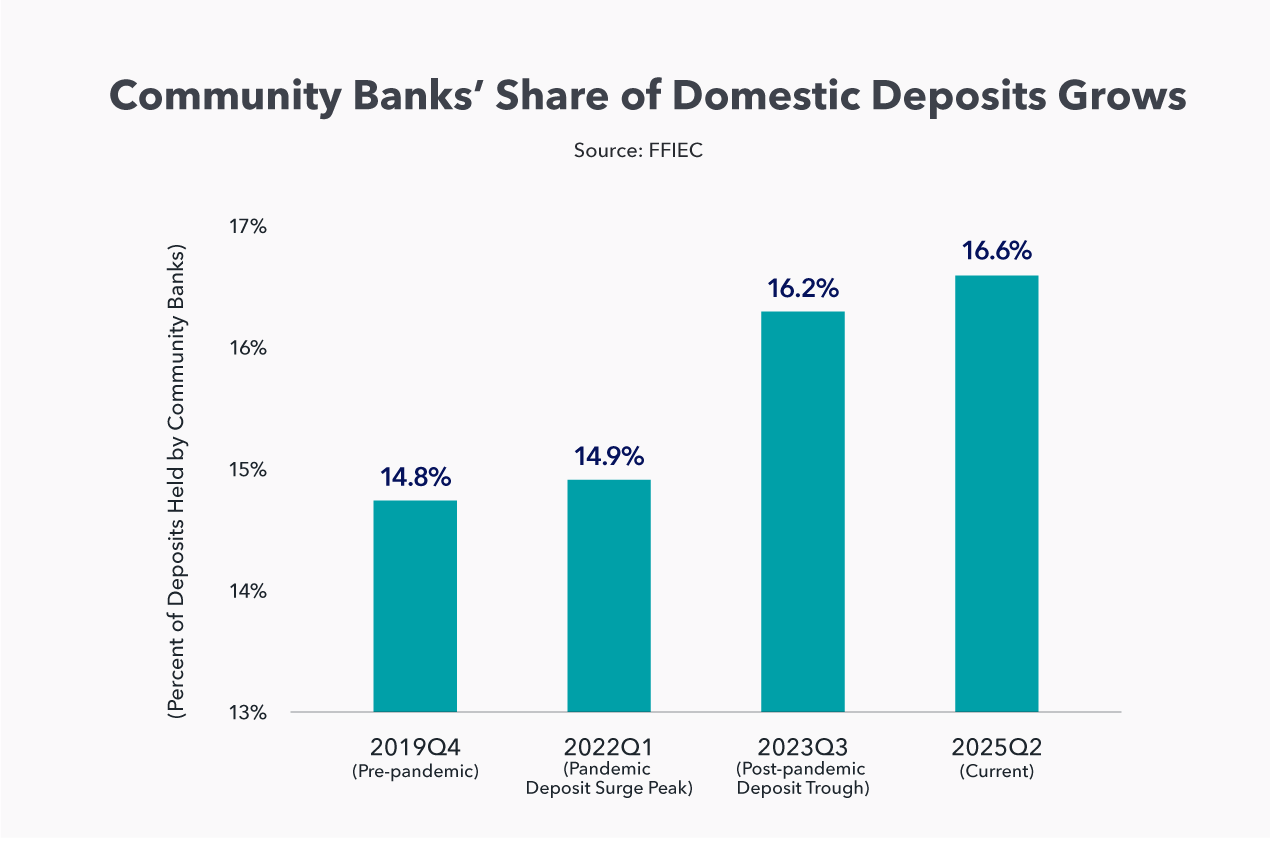

New research from IntraFi shows that when it comes to deposit growth, community banks are outperforming larger peers and growing market share on a merger-adjusted basis—even through economic ups and downs. Community banks’ resilience and performance continue to drive momentum and we’re proud to support this growth.

.png)

September 25, 2025

IntraFi’s latest research shows deposit growth is back on a sustainable path. While growth has normalized, the aggregate deposit level at YE24 remained $1.7 trillion above the pre-pandemic trend line—marking a new baseline for the industry.

August 14, 2025

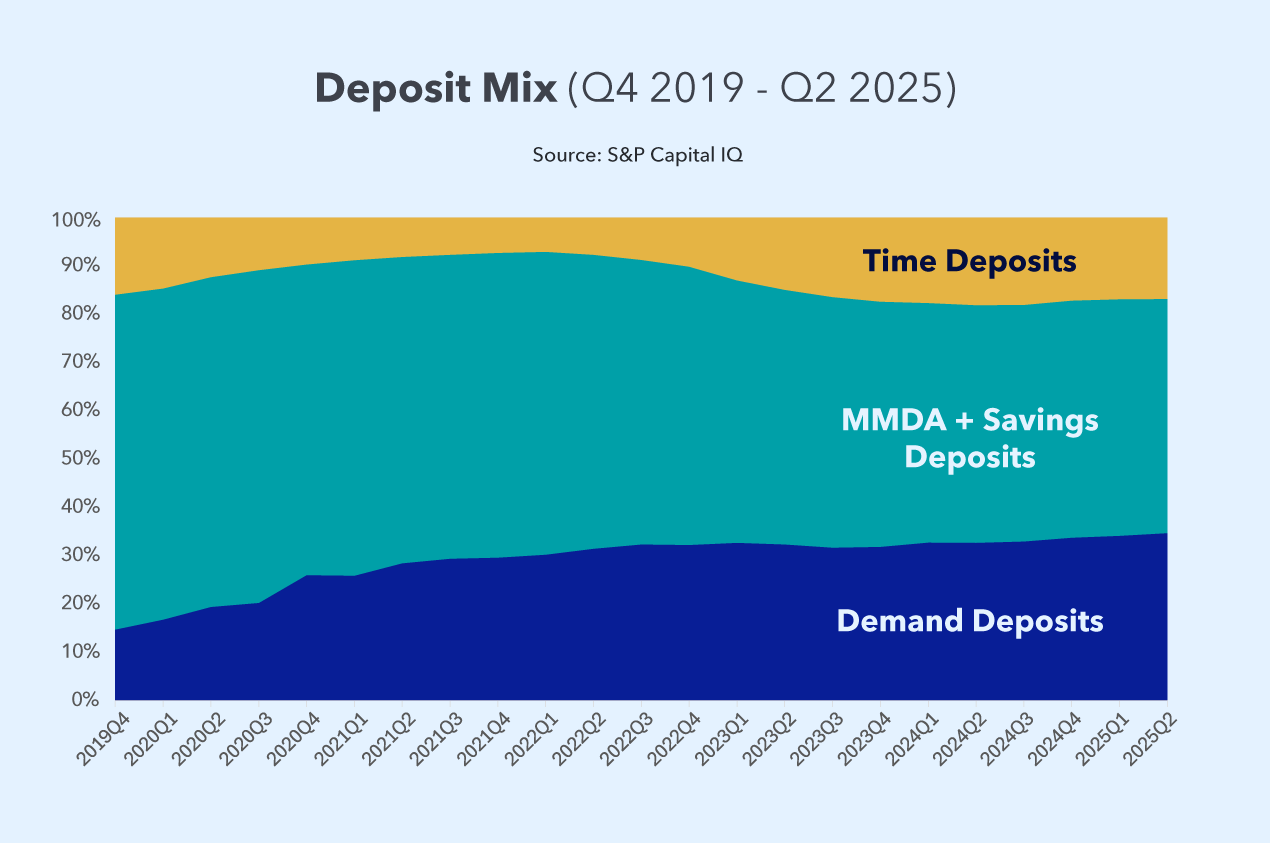

US banks' deposit growth remained resilient through Q2 2025 according to newly released call report data. With markets expecting at least one interest rate cut in the second half of 2025, is your bank anticipating accelerated growth and/or a near-term shift in deposit mix?

June 26, 2025

Deposits have reached a seasonally adjusted all-time high, surpassing pandemic-era levels and following a stable trajectory supported by persistent loan growth.

May 21, 2025

Q1 call report data also shows that banks continue to increase their utilization of reciprocal deposits. This has been particularly true during periods of industry stress, including the pandemic period (2020-2022) and the regional bank crisis (2023).

May 12, 2025

Newly available call report data for Q1 shows that domestic deposit growth continued its recovery in early 2025. Given the backdrop of more recent events, do you expect this trend to continue through the year?

April 16, 2025

Impact banks such as minority-owned and community development banks are significantly more likely to operate bank branches—and maintain deposits—in persistent poverty counties to support local development opportunities, according to data from the FDIC and CDFI.

March 31, 2025

Since the pandemic, depositors appear increasingly sensitive to media coverage of economic policy uncertainty. In today's landscape, banks that help customers prepare for a range of potential outcomes may be more likely to retain them—and attract new ones.

February 12, 2025

Year-end call report data shows that community banks increased their core deposits by $117 billion, or 5%, in 2024. This represents more than two-thirds of community banks' total deposit growth last year.

February 10, 2025

Newly available call report data for Q4 2024 shows that annualized Q4 deposit growth rates outpaced year-over-year growth rates for banks of all sizes, suggesting continued strength in bank deposit growth going into 2025.

December 18, 2024

While banks have retained $2.0 trillion from the Pandemic-era deposit surge, deposits have returned to their pre-Pandemic levels relative to U.S. GDP, indicating that banks can sustain the new, elevated deposit level.

December 12, 2024

Commercial bank deposits have re-established their historical growth pattern at a new, elevated level following a multi-year period of deposit market dislocation that began with the pandemic.

November 22, 2024

Q3 call report data shows that banks are better prepared now to absorb security portfolio stress than they were leading up to SVB's collapse.

November 13, 2024

Newly available FDIC Call Report data shows that deposit growth resumed in Q3, supported by banks of all sizes.

October 10, 2024

The Fed’s 50-bps cut has so far had a bigger impact on the rates paid by money market mutual funds, whereas banks have mostly kept their rates on money market deposit accounts steady.

September 27, 2024

Investments in retail money funds appear to have slowed in the days immediately following the Fed's interest rate cut. Is this a blip, or is it an early signal of what is to come?

September 12, 2024

Funding mix shift coming? The Fed is widely expected to lower interest rates next week. History suggests this will lead to a drop in time deposits.

August 12, 2024

Smaller banks added deposits in the second quarter, while super-regional and mega banks saw their deposit levels decline.

August 1, 2024

With markets seeing a September interest rate cut as increasingly likely, banks might expect deposit relief not only in terms of cost but also availability. Data shows that money market fund (MMF) yields are strongly correlated with changes in the Fed Funds Effective rate, meaning MMF yields will likely begin to fall soon after the Fed makes its first cut. In contrast, bank deposit data shows that banks passed along only 37% of the Fed’s rate cuts in the last falling-rate window from Q4 2019 to Q2 2020.

May 9, 2024

A year after SVB’s collapse, and several months after the FDIC enhanced supervision of banks with uninsured deposit levels above 50%, banks have reduced large deposits as a percentage of their overall deposit mix. (SVB’s were around 90% when it failed.)

April 18, 2024

Large time deposits hit an all-time high on February 28 before declining throughout March. But in April, they’ve been rising again. Have they peaked, or did last month represent a temporary dip?

April 9, 2024

Community banks are famous for their customer service. No surprise, then, that the lion’s share of IntraFi-placed reciprocal deposits—used to forge stronger, deeper relationships with local customers—are held by smaller institutions.

April 4, 2024

Loan-to-deposit ratios at year-end 2023 showed that community and midsize banks—including mission-driven banks designated as CDFIs and/or MDIs—allocated a greater share of their deposits to lending activity in support of local economic development.

March 25, 2024

On average, banks of all sizes saw deposit growth in Q4 2023; however, only the community bank sector produced loan growth rates that outpaced deposit gains.

March 14, 2024

FDIC Call Report data at year-end 2023 showed US commercial banks’ large time deposits climbing to 4.8% of total deposits, nearly erasing the entire drop seen after the 2016-2018 rising-rate period. FRED data from early 2024 shows banks’ continued increase in large time deposits to start the year.

March 8, 2024

Ahead of the expiration of the Bank Term Funding Program (BTFP) on March 11, participants hold $160bn+ of advances. Banks will need to seek funds from other sources to repay the loans as they mature over the next 12 months.

February 27, 2024

After six straight quarters of decline, total deposits of U.S. banks reversed course and grew in the fourth quarter of 2023, rising to $18.8T.

February 26, 2024

After peaking at more than $2.5T in December 2022, Overnight Reverse Repo Facility balances have fallen to around $500B as of February 2024. The continued decline of the facility’s usage has the industry anticipating reserves in the banking system will decline as the Fed continues QT.

Find Us Here

January 23, 2026

Georgia Municipal Association Cities United Summit

Join us at the Cities United Summit!

February 1, 2026

Bank Director’s Acquire or Be Acquired Conference

Join us at the Bank Director’s Acquire or Be Acquired Conference!

View all Events

Articles

September 12, 2025

Strengthening Franchise Value: Why Community Banks Are Growing Their Use of Reciprocal Deposits

Community banks are increasingly using reciprocal deposit networks to meet growing deposit competition.

July 7, 2025

Reduce Collateralization: A Path to Greater Efficiency and Depositor Satisfaction

Managing deposit collateralization can be a challenge in any environment. But in today's volatile financial landscape, the liquidity constraints imposed by collateral can be especially burdensome.

View all ARticles

A list identifying IntraFi network banks can be found at www.IntraFi.com/network-banks.

Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits.

Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits.

© Intrafi LLC.